Sparking sustainable success

Partner with us – and revolutionise your business

We work with different types of business partners to help them do business better, in a way that’s better for everyone.

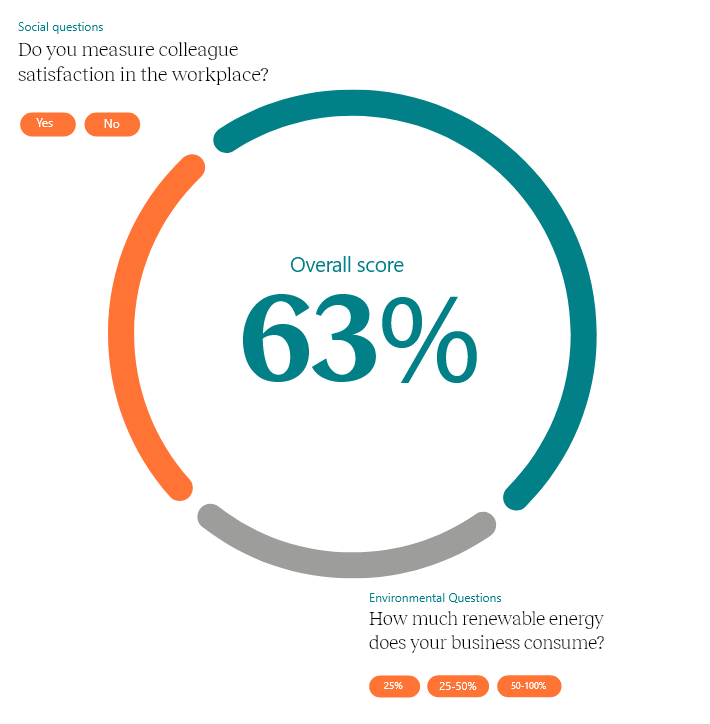

Our expertise lies in data-driven analysis and consultancy for ESG and business resilience.

We leverage innovative technology to deliver:

- Fast, automated assessments and analytics

- Benchmarking reports for start-ups, scale-ups and large companies

- Valuable insights and intelligence

- Expert guidance and support at every step

Let us know how we can help you navigate the ever-changing business landscape you work within.

How can we help your business?

Private Business

To reach the next level of success, sustainable growth is key. Whether you’re a fund manager, large private company or SME, our independent team can help you maximise your potential.

Financial Institution

Strengthen your SME customer base by responsibly providing the resources they need to become more resilient and more sustainable – so they can thrive in their respective industries.

Listed Company

Use our fast, cost-effective services to uncover your company’s most significant ESG and business resilience results (and problem areas) across divisions and regions to maximise corporate success.

Consultancy or Accountancy Firm

Elevate your client base with sustainability services tailored to their specific needs. With our scalable solutions, you can provide the right amount of support at any time, ensuring positive impact and growth.

Sustainable collaboration

The Disruption House has partnered with Compare Your Footprint, offering organisations high quality carbon calculation software and expertise. Compare Your Footprint and TDH have a powerful digital diagnostic tool that can help uncover your current Environmental, Social and Governance (ESG) health of your business or customers, while also giving insight into how to lay out an action plan for improvement.

Ecovis stands out as a distinguished member of ECOVIS International, offering a comprehensive range of services including Audit & Assurance, Business Advisory, Corporate Finance, Outsourced Business, and Tax. Renowned for their expertise in sectors like International Business, Creative Industries, Financial Markets, Green & Sustainable Initiatives, and Technology, Ecovis is committed to fostering better business by doing good. Their approach is deeply rooted in their purpose and values, focusing on inspiring better business and building enduring client relationships.

With a global presence across more than 90 countries, and revenues exceeding $1 Billion, Ecovis is uniquely positioned to provide insightful and professional services, ensuring their clients’ businesses thrive and excel in today’s dynamic environment. Their collaboration with The Disruption House is set to enhance the capabilities of both entities, offering unparalleled expertise in sustainability, business resilience, and ESG consulting.

Get started

today

Explore a game-changing service that gives you fast, responsive access to expert assessment and analysis, plus top consultancy insights and advice – at a very affordable price.