To help deliver this, it is critical to upgrade the data quality and volume at industry and entity level that supports rapid, and confident decision-making, fit for the speed at which the climate tech revolution will play out over the next 25 years.

COP30 was very relevant…for business

As is customary, COP30 negotiations ran long into the final night of 21st November, concluding with a compromise to uphold global climate co-operation despite significant adversity. This was a win for the future of COP, but fell short of securing a pathway for eventual fossil fuel phase out. Despite the short-comings, the event was significant for three reasons:

-

Demonstrating that countries are still working towards decarbonisation, evidenced by the late but significant surge in new NDC submissions now covering 73% of global emissions, compared with just 30% before the event in September.

-

That collaboration between countries remains higher than expected in the face of disruptive intentions from some members.

-

That intention remains high but government action to boost specific financial commitments is falling behind. This was the COP that puts the future of climate-mitigation firmly in the hands of business and the private sector to deliver the solutions and the money to implement it.

Time is running out…

The poor global financial response to the climate crisis means our window to 1.5 is shrinking as fast as our 200Gt carbon budget, which at today’s burn rate of 40Gt a year will be used up by 2030. We are already on the threshold of long-term 1.5 degrees, having flirted with it this year, and the planet is warming at the fastest rate since records began(1). To stall the increase in temperatures, global atmospheric emissions have to fall 50% by 2030, and then to (net) zero by 2050.

…but money can buy time

The investment needs across jurisdictions and sectors to bring net zero back into view are daunting – but potentially achievable. The Network for Greening the Financial System (NGFS) scenario analysis estimates that net zero by 2050 will cost $7.0-10tr a year, or $225tr – 270tr cumulatively(2). The Climate Policy Initiative also puts the cost at around $8.6tr a year(3). That’s the equivalent of building one Saudi NEOM mega-city every year. But while NEOM may never achieve economic break-even, the ROI on climate-adaptation and mitigation investment can be found in both commercial value created and losses avoided over time.

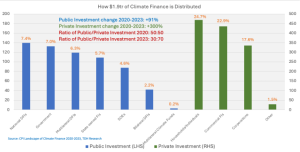

To put the challenge into context, in the last 7 years (2018) we have spent a total of $9.5tr on net zero, equating to an average of around $1.4tr a year, with 2024 encouragingly breaking through $2.0tr for the first time, so the transition shortfall if we include this is between $4.6-6.7tr a year.

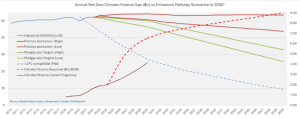

Our climate finance pathway (Fig. 1) is currently sufficient to keep GHG emissions constant (Policies and Action range), or equivalent to 2.5-2.9 degrees of warming. If we include all countries NDC commitments (Pledges and Targets), emissions should decline to 25-35Gt per annum, or equivalent to 2.1-2.6 degrees of warming. The dotted lines show the potential for financial intervention to accelerate 1.5 degree targets as we rapidly mobilise private capital to invest in climate mitigation and technology.

Sensing Opportunity

The outlook for future climate conferences is likely to reinforce the stalemate between countries, but where commitment has been dialled down, thinking outside of COP has become alive to the economic opportunity for private sector engagement, driving a steady but significant increase in financial, technical and human resources into solving climate challenges. Business now accounts for 70% of the expanding climate finance pie, from 50% back in 2020.

What are businesses seeing in taking climate action?

-

Operational Benefits – evidence continues to mount that companies adopting better sustainable strategies are seeing increased opportunities for revenue generation, cost-savings, new markets and access to capital, as well as finding potential for improved operating resilience.

TCFD’s 2023 Status Report(6) published details of a CDP corporate climate impact survey of 2,700 companies indicating that 63% of large companies identify climate-related opportunities as materially beneficial for business, boosting demand for products and services. 56% of companies estimate that climate action could positively impact revenues by up to 5% a year, and 16% estimate a revenue boost of 6-15%.

A more recent BGC Climate Survey(7) identifies the shifting trend for businesses to repurpose costs associated with climate risk, towards increasing investment in climate opportunity, as 82% of those surveyed see the benefits of mitigation emerging in the form of revenue growth and savings on opex/capex.

-

Follow the Money – Having already seen the positive economic impact of relatively modest climate action in recent years, businesses are mobilising to compete for the new markets, products, efficiencies and opportunities presented by the additional $6tr transition opportunity. The investment potential to 2050, according to IEA data is shared between a number of key sectors.

-

Employment – the net zero transition-related investment across core energy, technology, industrial and transport sectors will create 30 million new higher skilled jobs by 2030 (IEA). That’s 30 million new consumers eager to buy goods, eat out and make lifestyle purchases such as cars, homes and holidays using credit cards, loans and mortgages.

-

Risk management – climate mitigation is not just a commercial opportunity, it provides the business world with powerful tools for risk management, monitoring and data analysis. Companies will always allocate capital to boost longevity and security.

Which sectors are targeting the gap?

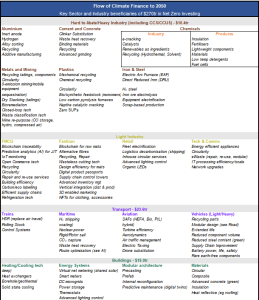

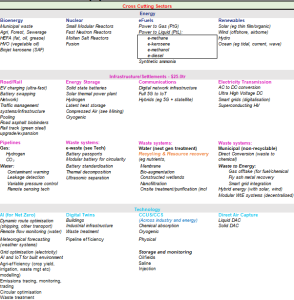

The IEA estimates that the clean energy and energy technology sector could double global investment from $2.0tr to over $4.5tr a year, spilling into the super-sectors including Buildings, Transport, Industry, Infrastructure, Electricity Generation and Fuel Production.

On a more granular basis, it is clear that the transition impact is trickling down into multiple different sectors and sub-sectors, some of which may only have come into existence as a result of the call for action in Paris 10 years ago. The mutually beneficial alignment between recent advances in technology and the potential for addressing climate goals (and capital) is spawning fresh ideas, innovations and genuine excitement in business communities, translating into accelerating capital investment.

Technologies taking us to Net Zero

The technologies being rolled out to fulfil Net Zero strategies are proliferating, and in the run up to 2050 many of the innovations below will become significant and mature sectors in their own right. Below are just a few of the emerging (and evolving) investment target innovations being used to recycle, reduce, remove and repurpose our carbon emissions to make mitigation and adaptation a success (not incorporating the additional possibilities associated with Nature-based solutions).

Private sector funding the transition technologies

The private sector exposure to net zero finance has grown by 300% between 2020 and 2023, at this rate potentially unleashing hundreds of trillions of investments, loans and debt/equity instruments including new and novel structures in the decades to come. FIs such as banks, asset managers, insurance companies have assumed 23% of the annual investment needs so far. The capital required to meet net zero is not dependent on the net zero commitments made by financial institutions through alliances such as NZBA or NZAM. Where such commitments have been welcome, the lasting impact will not be membership, but the enduring infrastructure created to guide best practise. So where NZBA commitments fell 30% in 2024, actual investment exposure in transition technologies grew 10% in the same time period. In another example of the investment shift from old to new tech – direct project finance by commercial FIs’ to clean tech outstripped fossil fuels by over 2:1 in 2024(9). But this has to grow exponentially.

Banks hold the keys to the transition for large and small companies

The majority of these technologies will require funding and investment, and most of this will touch a bank either directly or indirectly. Even if the technology forms part of a larger corporation’s R&D, it is probable that finance will be structured through a combination of internal cashflows and debt.

If the technology is a start or scaleup or SME then financing again will be linked to a bank in the form of overdrafts, loans or credit cards, as well as other forms like invoice financing or hire/lease arrangements, and to a lesser extent grants, crowd-funding and direct equity investment. In the UK 65% of SMEs with 10-49 employees use a form of external finance, around 28% of scaleups and SMEs use overdrafts, loans and credit cards, and 20% use other finance products like leases and equity investment(10)

As demonstrated above, the climate transition requires businesses to mobilise and scale some of the most advanced technologies under development. The investment risks are high and often need to be shared in a public/private structure where government-backed funds are deployed to kick-start private investment. Typically for every $1.00 of public money invested in the transition, the private sector is expected to leverage this by 4-6x. In the UK this increases over time:

Taking this ratio as a typical public/private split and by applying the global sector IEA investment estimates it is possible to see a pathway for banks and other financial institutions globally to contribute over $190tr to transition finance between now and 2050.

What this means for the UK

The Climate Change Committee’s (CCC) Seventh Carbon Budget estimates the UK should invest £26bn ($34bn) a year in decarbonisation to 2050, which climbs to over $65bn when attributing the UK’s global emissions share of 0.73% (386 million t/CO2e – EDGAR database(12)) to the CPI global transition spend estimates above. Essentially the UK needs to spend between 1.0% and 1.8% of GDP annually on decarbonisation and related technologies.

The private sector share of this ranges from $28bn – $54bn a year, equating to 5-10% of outstanding bank loans to businesses(13). FIs will clearly be instrumental in supporting this opportunity, with the additional benefit of helping lenders to reduce their own scope 3 (Category 15) financed emissions calculations as this tranche of funding is linked directly to decarbonisation.

The necessity, opportunity, commercial benefits and capital are abundant, so are the hurdles

We are at the foothills of a climate tech revolution, one that will deliver the direct and indirect commercial benefits expected by banks and investors. Where ROI is valued as much as the planetary benefits these technologies bring. But making finance available to this industry is beset with challenges linked as much to traditional conservative loan practises and due diligence procedures, as a lack of data and industry information that can smooth approvals and increase confidence. For example(14):

-

Mitigation technology is a comparatively recent arrival in the portfolio of financing institutions. It lacks a track record in historic deliverables and benchmarks.

-

The sector is hard to compare with other technologies as it is often dependent on longer term goals and targets than usually acceptable to financiers, creating a duration mismatch between long-term projects and short-term funding.

-

It tends to involve investment in a combination of high-end software and hard assets which can be very expensive, and very specialist with a limited history of effective deployment.

-

It often involves the need to scale rapidly, with an emphasis on speed of delivery over perfect execution.

-

The window for funding and subsequent success is smaller due to the capital intensity of projects and products, increasing the need for accelerated decision-making on funding agreements which banks may struggle with.

-

Interest rates when a loan is approved can be prohibitively high.

-

The businesses themselves often fail to provide the entity-level data required for banks to categorise them as mitigation supportive. Although their products or business model support decarbonisation for example, the operating entity has little information to support its own sustainable plan or pathway, making it harder for institutions to approve funding at speed.

-

The business itself may be too small to be in scope for sustainability regulation or disclosure requirements such as ISSB/TCFD or CSRD, but it could be providing a service or product in the supply chain of a company that is. Understanding where it sits and having the relevant data at hand will improve access to finance.

Many of these onerous wrinkles are being smoothed as businesses comply with mandatory reporting requirements in the UK and Europe, substantially increasing the number and quality of disclosures for banks to analyse and apply in practise to smaller enterprises. But for banks to accelerate flows of capital and reduce the number of issues above, business has to carry the responsibility of gathering and providing the necessary high quality data and information that supports lower risk and more rapid approvals. As the value creation of climate action impacts the ROI of businesses through more effective risk management or as a rapidly growing carbon reduction technology, confidence, risk pricing and capital facilitation will grow rapidly – potentially bringing us closer to net zero than we dare to hope for today.

References:

-

McKinsey – The Net Zero Transition, what it would cost, what it could bring (NGFS scenario analysis)

-

CPI Climate Finance Tracker 2024 (database)

-

TCFD 2023 Status Report (P.96)

-

Boston Consulting Group – How Companies are Tackling Climate Change and Creating Value 2025)

-

IEA – Net Zero by 2050, A Roadmap for the Global Energy Sector

-

Tracking the Transition – Global private financial institutions progress towards net zero (slide 45, CPI)

-

SME Finance Monitor (Q4 2024 report) – BVA BDRC

-

CCC – The Seventh Carbon Budget, Advice for the UK Government

-

Release – September 2025

-

Public Credit Guarantees: Unlocking Private Investments for Climate Technologies (Tech for Net Zero)