Nature and biodiversity became defining themes at COP30 as the conversation shifted from trillion dollar finance targets to practical, location based resilience. Policymakers focused on how local ecosystems, water basins, land use and supply chain dependencies shape climate and economic risk. This marked a strong move away from broad global pledges and toward the specific places where nature loss is already disrupting assets, operations and communities. For financial institutions, this shift signals that nature governance is becoming essential to investment oversight rather than a secondary sustainability topic.

Central to this transition is the Taskforce on Nature related Financial Disclosures (TNFD).

TNFD provides a structured method for institutions to evaluate how companies depend on and impact nature, and to map where physical and transitional risks are likely to emerge. Unlike climate, which can be summarised through global emissions profiles, nature risk is inherently place specific. Dependence on freshwater, exposure to high risk land use zones and links to biodiversity sensitive regions all vary from asset to asset. This means asset managers will increasingly require granular, comparable company level data to assess exposures across listed markets, private markets and SME portfolios.

The challenge is that most companies do not publish nature related information. Public market issuers are beginning to describe their dependencies and impacts, but the vast majority of private companies, mid market firms and SMEs report nothing in this area. For portfolio managers, these segments already represent areas of weak visibility, limited governance and underreported exposure. TNFD provides the framework to analyse these dependencies but not the data itself, so the question becomes how asset managers can gain clarity across large volumes of companies that do not disclose.

This is where TDH’s M3 model becomes valuable because it surfaces structured sustainability and operational risk intelligence even when reporting is weak.

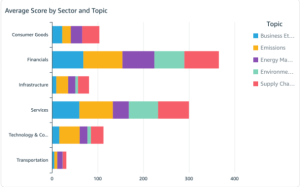

Sector level patterns from the dataset illustrate this data gap. Financial firms score strongly across all topics, reflecting mature governance, established policy frameworks and relatively advanced disclosure practices. Transportation sits at the bottom with single digit averages, followed closely by some consumer facing industries. These results do not imply that high scoring sectors have low nature exposure. Instead, they show that those firms have clearer systems in place for oversight, performance management and data capture. Low scoring sectors tend to carry unreported risks, weaker controls and limited readiness for TNFD aligned disclosure, which increases the likelihood of disruptive events or compliance challenges.

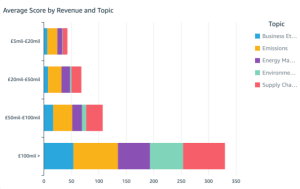

Revenue based results are equally significant. Larger companies outperform smaller ones across every topic, with firms above £100 million in revenue scoring around seven times higher than the smallest group. This is partly due to capacity. Bigger organisations typically have dedicated sustainability teams, more formal policies and established internal processes. Smaller firms often operate without these structures. For asset managers, this means that the private and mid market segments of their portfolios contain the largest blind spots. Many companies in the private and mid market segments operate in sectors with direct links to physical operations and regional supply chains, which can increase their exposure to location specific nature related risks. When combined with limited disclosure, this creates some of the least visible parts of a portfolio from a TNFD perspective.

Topic specific patterns provide additional insight into where operational strength and weakness lie. Emissions, supply chain management and energy management are the highest scoring topics, which aligns with areas that have seen regulatory pressure for many years. Environmental frameworks and business ethics rank lowest and show large performance gaps between leading and lagging companies. Firms that perform well in these areas tend to have formal governance, oversight structures and cohesive sustainability programmes. Those that score poorly typically lack policies, controls and accountability systems, which increases the probability of regulatory non compliance, reputational disruption and unpriced transition risk.

Furthermore, biodiversity scoring provides an early indication of TNFD readiness because it reflects whether companies have already begun identifying, managing and disclosing their interactions with nature. TNFD requires firms to understand their dependencies on ecosystems, assess potential impacts and develop plans for monitoring and mitigation. Companies that already track biodiversity targets, operational impacts or conservation measures have the foundational structures TNFD expects. Those with no biodiversity reporting are starting from zero, which suggests they will face a steeper path when nature-related disclosure becomes mandatory.

The trend we see in biodiversity is striking: A small group of firms score highly while the majority register no activity at all. This creates a bimodal distribution where many companies score zero, a smaller cluster sits in the upper range and almost none fall in the middle. For wealth and asset managers, this indicates that nature related risk is currently concentrated in two places. First, in high exposure sectors that have not yet begun reporting. Second, in a small group of leaders that are already disclosing in detail. Differentiating between these groups will become a central part of stewardship, risk oversight and fund selection as TNFD guidance becomes mainstream.

As nature related frameworks accelerate and TNFD becomes integrated into reporting and regulation, asset managers will need both structured frameworks and structured data.

High scoring companies in the dataset reflect stronger governance, clearer oversight and reduced probability of hidden risks. Low scoring companies signal weak systems, limited disclosure and higher potential for unpriced nature and transition exposure. Tools like TDH M3, which deliver consistent, machine assessed sustainability and resilience intelligence across listed and private companies, provide the visibility that wealth and asset managers need to understand where nature related risk is likely to emerge and how it may influence portfolio performance in 2026 and beyond.