Insurers are accustomed to grouping risk. Industry codes, revenue bands, employee counts, and peer comparisons have long formed the backbone of commercial underwriting models. By clustering businesses that look similar on paper, insurers can price efficiently at scale and manage portfolios with consistency.

That logic is now being tested.

Extreme weather, energy price volatility, regulatory pressure, and supply-chain disruption are no longer isolated events. They are persistent features of today’s risk environment, and they do not affect all companies equally, even when those companies operate in the same industry and size bracket.

To illustrate this, consider Company A and Company B. Both operate in the apparel-related sector. Both generate between £5 million and £20 million in revenue and employ between 50 and 249 people. Under grouping-based underwriting approaches, they would typically be treated as broadly comparable risks.

TDH data adds a deeper layer of insight.

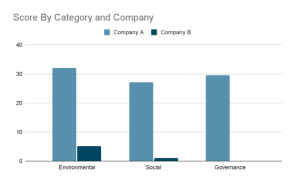

When assessed using TDH’s disclosure-based ESG score, the gap between Company A and Company B is substantial. The overall ESG score represents the average of Environmental, Social, and Governance pillar scores, benchmarked against sector peers with the same revenue and employee profile. On this basis, Company A achieves an overall ESG score of 29.5, while Company B scores just 2.1, despite operating under the same commercial conditions.

| Category | Company A | Company B |

| Environmental | 31.94 | 5.2 |

| Social | 27.06 | 1 |

| Governance | 29.63 | 0 |

This divergence becomes clearer when the underlying pillars are examined. Company A demonstrates structured performance across environmental management, workforce and social practices, and governance controls. Company B, by contrast, shows limited evidence across most of these areas, with activity concentrated in only a narrow subset of metrics.

Company Scores by ESG Pillar, The Disruption House (2026)

From an insurance perspective, these are not abstract ESG indicators. They are supplementary risk signals that are added on top of traditional underwriting inputs.

A low overall ESG score reflects gaps in emissions management, energy oversight, governance processes, and social risk controls. These factors increase exposure to regulatory change, energy cost volatility, operational disruption, and reputational events. While they may not replace core underwriting data such as claims history or financials, they provide early warning signals that help explain why losses may emerge or intensify.

Company A’s higher overall ESG score suggests stronger internal controls, clearer accountability, and greater preparedness for transition-related and operational shocks. Used in conjunction with existing underwriting models, these signals help insurers refine pricing assumptions, identify fragile exposures earlier, and strengthen portfolio oversight.

Traditional underwriting models that rely on grouping methods and peer assumptions remain essential. However, on their own, they can miss meaningful differences in how individual companies manage risk. By layering TDH’s ESG and operational risk insights on top of existing frameworks, insurers gain a more complete view of exposure without disrupting established processes.

TDH provides insurers with structured, comparable ESG data on private companies and SMEs, designed to complement existing underwriting approaches. This allows insurers to differentiate risk within the same industry, revenue band, and workforce size, while continuing to rely on the models and expertise they already trust.

The difference between Company A and Company B highlights a simple reality. Risk no longer lives only at sector level. It lives at company level, in the detail. Supplementary insight is what turns that detail into underwriting advantage.